Ther are multiple type of Axis Bank Savings Account which gives its customers a wide range of savings accounts, as well as personalized services and enticing perks. The bank’s savings account has interest rates that start at 3% per year. Customers can plan their funds and keep track of them. They can also save a lot and earn interest on their savings. Axis Bank users have a lot of options for how to manage their money, so they can open a savings account that works best for them. Users are able to get their money into their savings accounts at any one of the 11,500 Axis Bank’s ATMs and 2300+ Axis Bank workplaces which are spread off throughout the nation as a whole. Most of the time, Axis Bank doesn’t have minimum balance requirements if an account user has a fixed deposit or recurring deposit with the bank for about a year.

Revision of Interest Rates on Axis Bank Savings Bank Deposits

Savings Account Interest Rates

| Balance Slabs | Applicable Rate of Interest w.e.f. 1st Jun, 2022 |

| Less than Rs. 50 Lacs | 3.00% p.a. |

| Rs. 50 Lacs and up to less than Rs. 800 Crs | 3.50% p.a. |

| Rs. 800 crs and above | Overnight MIBOR + 0.70% |

| Saving Deposits Balance of Rs.100 crore to Rs.200 crore | Repo + (-0.50%) |

Changes to the interest rates on savings bank deposits at Axis Bank

How do I open a savings account online with Axis Bank?

Axis Bank’s web site lets customers compare savings accounts and open the one they want quickly and easily. The “Apply online” button on the website takes the person to an application form that they need to fill out and send in. People’s names, addresses, phone numbers, chosen branch and city, and the kind of savings account they want to open must be entered. Then, these information have to be checked and sent in. Along with the application, all of the required papers must also be sent. As part of its introduction program, Axis Bank sends a welcome kit to each new account holder. When a savings account is started, a debit card is also given out. The debit card is unique to the type of savings account chosen.

Types of Savings Accounts at Axis Bank

EasyAccess Savings Account: Start saving with an EasyAccess savings account from Axis Bank. Your daily amounts earn 4% interest, which is paid out every three months. Axis Bank’s internet and mobile services make it easy to get to your bank account and keep track of how much you spend. Opening an EasyAccess savings account in a Metro city requires a fee of at least Rs 10,000. Most of the time, an EasyAccess savings account comes with a Visa Classic debit card.

Prime Savings Account: If you have a Prime Savings Account with Axis Bank, you’ll have better access to your money and be able to make more transactions. When you open a Prime savings account, you also get a MasterCard Titanium Debit Card.

Future Stars Savings Account: With an Axis Bank Future Stars Savings Account, parents can plan and save for their child’s future. This account is for kids younger than 18 years old and can only be used by a parent or adult. If the child is under 10 years old, the guardian will get a free ATM card with a daily withdrawal cap of Rs 1500/- and a checkbook in the child’s name. In Metro cities, to start a Future Stars Savings Account, you only need a small deposit and a balance of Rs 2500/- every month.

Senior Privilege Savings Account: When a senior opens a Senior Privilege Savings Account, they can get special treatment at Axis Bank offices and get discounts and special deals.

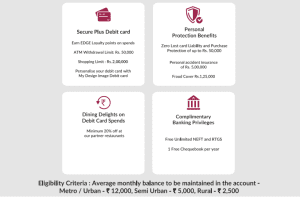

Easy Access Savings Account:

An easy access savings account is a type of account that allows you to deposit and withdraw money whenever you want. These accounts usually offer a lower interest rate compared to other types of savings accounts, but they provide you with the flexibility to access your money whenever you need it. Easy access savings accounts are a good option for people who want to save money but also want the freedom to use their funds whenever they need them.

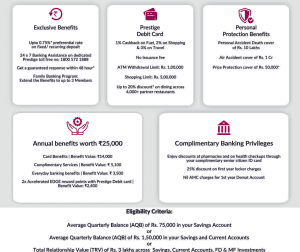

One Pager Prestige Senior Account:

The Prestige Senior Account is a savings account designed specifically for seniors aged 60 and above. This account offers a higher interest rate compared to other savings accounts and provides seniors with additional benefits such as free checkbook and free ATM transactions. The Prestige Senior Account is a good option for seniors who want to save money and earn a higher interest rate on their savings.

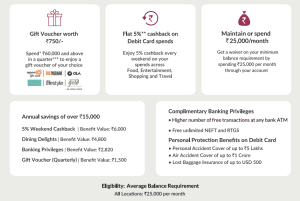

One Pager Liberty Savings

The Liberty Savings account is a high-yield savings account that offers a competitive interest rate and no monthly fees. This account is designed for people who want to save money and earn a high return on their savings. The Liberty Savings account is a good option for anyone who wants to earn more interest on their savings without having to pay any fees.

One Pager Prestige Savings

The Prestige Savings account is a high-yield savings account that offers a competitive interest rate and no monthly fees. This account is designed for people who want to save money and earn a high return on their savings. The Prestige Savings account also provides additional benefits such as free checkbook and free ATM transactions. This account is a good option for anyone who wants to save money and earn a high return on their savings.

Burgundy Savings Account:

The Burgundy Savings account is a savings account that offers a high interest rate and no monthly fees. This account is designed for people who want to save money and earn a high return on their savings. The Burgundy Savings account also provides additional benefits such as free checkbook and free ATM transactions. This account is a good option for anyone who wants to earn a high return on their savings without having to pay any fees.

Pension Savings Account:

The Pension Savings Account is only for people who are retired from the Central Government, the Civil Ministry, or the Defense Ministry. There is no average quarterly minimum sum requirement for the pension amount, and the Central Civil Pension would be sent to this account.

Insurance Agent Account:

This savings account is just for insurance agents and requires a lower starting deposit of Rs 5000/-. Along with this account, a Visa Classic Debit card is given out.

Basic Savings Account: Axis Bank’s Basic Savings Account comes with a free Rupay Debit card and the ability to have a zero amount. Customers can keep track of what’s going on with their account by getting free SMS alerts and a passbook.

Small Basic Savings Account:

As the name suggests, an Axis Bank Small Basic Savings Account is a good way to start saving money. There is no minimum amount requirement. With this account, you get a RuPay debit card, and regular e-statements or passbooks make it easy to keep track of your spending.

Liberty Savings Account:

With this account, you can either spend the money or keep at least Rs.25,000 in it each month. On the weekend, you’ll get 5% cash back on spending on travel, shopping, entertainment, and food.

Prestige Digital Savings Account: With this savings account, you get a free quick e-debit card. You’ll get 1% cash back on online shopping, gas, and travel with this bank card. On Flipkart and Amazon, you will also get 12.5% cash back.

Priority Digital Savings Account: With this savings account, you get a free quick virtual debit card that gives you 1% cashback when you shop online. On Flipkart and Amazon, you will also get 15% cash back.

Burgundy Digital Savings Account:

When you start a Burgundy digital savings account, you get a free instant debit card with a 1% cashback offer. You’ll also get 15% cash back when you use this credit card to buy things from Amazon and Flipkart.

Government Scholarship Savings Account: With a Government Scholarship Savings Account, you’ll get a Rupay Platinum Debit card that lets you take out up to Rs.40,000 per day from ATMs. You can also make as many cash deposits as you want without paying anything.

Rates of Interest on Savings Accounts at Axis Bank

Customers of Axis Bank can earn up to 3.75 percent interest on their savings accounts and get a lot of other perks and deals when they use their accounts. The interest rate is worked out every day, and account users get their money every three months.

Minimum balance requirements at Axis Bank

There are different minimum balances that need to be kept in Axis Bank savings accounts, based on the type of account and who it is for. The minimum sum can be as low as Rs.2,500 and as high as Rs.1,00,000.

Axis Bank Savings Accounts: Who Can Get One?

An Axis Bank savings account can be opened by any Indian individual or Hindu Undivided Family (HUF).

Eligibility – Axis Bank Savings Accounts

All entrants need two photos the size of a passport.

Evidence of Age

When applying for a joint account, both people need to show proof of identity. The main account holder’s address can be used as proof of residence, and the two people need to show that they are related.

ID/Address Verification

Valid Valid Passport PAN Card Voter’s ID Driving License Job Card given by NREGA and signed by a State Government official Letter or Card issued by Unique Identification Authority of India (UIDIA) – Aadhaar document

Address and proof of identity for Hindu joint family accounts

PAN Card/HUF Declaration Form 60 from the Karta

Proof of Karta’s name and location, according to the paperwork for the person

Prescribed Joint Hindu Family Letter, which all adult users must sign.

Needed Paperwork: Salary Accounts

Professionals who get paid by the hour need to send a real authorization letter from their employers in the format that the bank wants.

Proof of photo ID: PAN card, passport, voter ID card, or photo ID from the government, the military, or the public sector.

Driving License

Any proof of address will do.

Bill for the phone, cell phone, or electricity.

Ration Card Letter of Registration for a Gas Connection

Assessment order for income tax and wealth tax

A signed lease agreement and an energy bill in the landlord’s name.

When opening a joint savings account, both the applicant and the co-applicant must bring the papers listed above.

Other things you can buy from Axis Bank

Popular Pages: Savings Account

Savings Account Pages That Are Hot

Questions and Answers about Axis Bank Savings Account

What kinds of Savings Bank Accounts does Axis Bank offer?

Axis Bank has a variety of Savings Bank accounts to meet your needs. Some of them are the EasyAccess Savings Account, the Pension Savings Account, the YOUth Account, the Women’s Savings Account, the Future Stars Saving Account, the Trust/NGO Savings Account, and the Senior Privilege Savings Account, among others.

How many times can you make a trade with an Axis Bank Prime Plus Savings Account?

At any Axis Bank store, you can make up to 20 free transactions per month. Transactions include getting cash out or putting money in and asking for a demand draft or pay order.

Is there a minimum amount I need to have in my Axis Bank Pension Savings Account before I can open it?

The Axis Bank Pension Savings Account doesn’t need to have a certain average amount every three months.

How much can you take out of your Axis Bank Women’s Savings Bank Account at one time?

The Women’s Savings Bank Account lets them take out up to Rs 40,000 per day from ATMs. The account also lets you spend up to Rs 10,000 per day on shopping.

Who can start a Prime Savings Account with Axis Bank?

Axis Bank allows people who live in India and Hindu undivided Families to open a Prime Savings Account.

What are some advantages of the Senior Privilege Savings Account?

Senior Privilege Savings Account holders at Axis Bank get a lot of perks, like the ability to pay bills at any Axis Bank branch, a discount of 20–60% at over 600 diagnostic centers for health checks, a discount of 15% at Apollo Pharmacies, a special senior’s ID card for emergencies, and many more.

Does the Senior Privilege Savings Account have a minimum age requirement?

Yes, to be qualified for the Axis Bank Senior Privilege Savings Account, the applicant must be at least 57 years old.

How much interest does the Axis Bank Basic Savings Account earn?

The Axis Bank Savings Account pays 4% interest on the daily amount. Interest is paid every three months