Aadhaar Card Pan Card Link Status: How To Check pan aadhaar link status?

Time is running out! The deadline to link your Aadhaar-PAN cards is fast approaching, and it’s crucial for all PAN card holders to take action. Linking your PAN card with your Aadhaar card is necessary to keep your PAN card active. But you may be wondering, “Is my Aadhaar already linked?” Don’t worry, we’ve got your back! We recommend you check the link status first. In this article, we’ll walk you through the simple process of checking if your Aadhaar is linked with your PAN card. And if it’s not, we’ll show you how to link them before the deadline of 30th June 2023, with a penalty of Rs.1,000.

The government has made it mandatory for taxpayers to link their Aadhaar cards with their Permanent Account Number (PAN) cards by 30th June 2023. Failing to link them will render your PAN card inoperative starting from 1st July 2023. It’s crucial to understand how to check the link status of your Aadhaar-PAN card, whether it’s through online methods, offline procedures, or even via SMS. Let’s dive in and find out!

How To Check Aadhaar Card PAN Card Link Status online?

There are two methods to check the link status of your Aadhaar card and PAN card online.

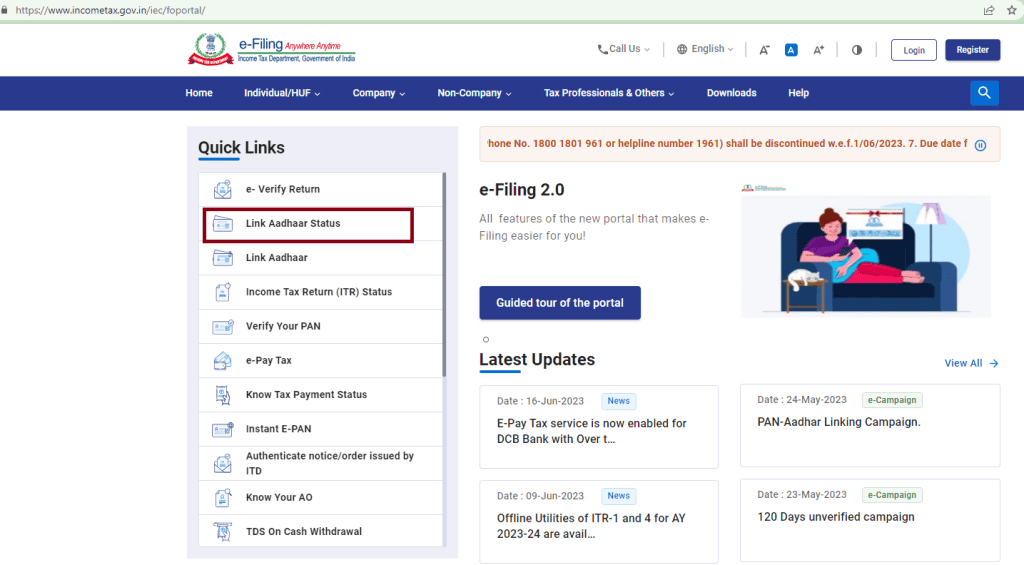

Check the Aadhaar PAN card link status without logging into the Income Tax portal

Method 1: Checking without Logging into the Income Tax Portal

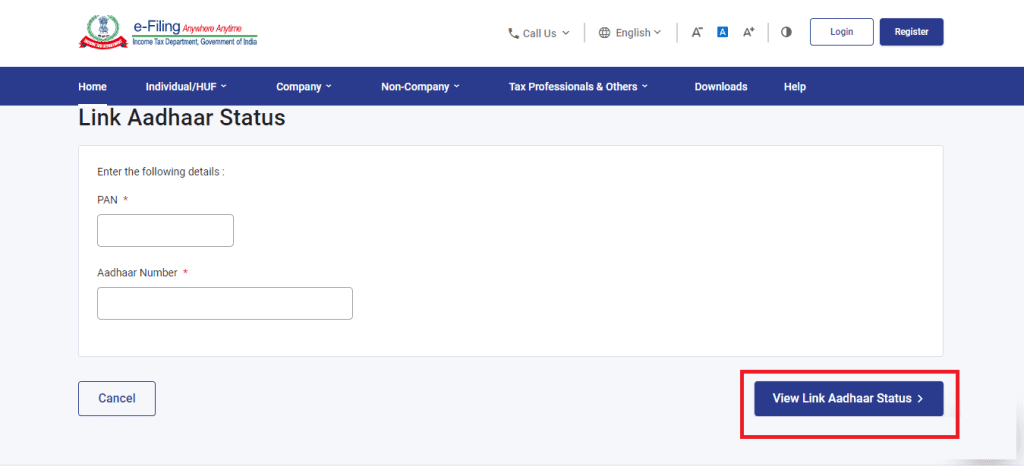

- Visit the Income Tax e-filing portal. https://www.incometax.gov.in/iec/foportal/

- Under the ‘Quick Links’ heading, click on ‘Link Aadhaar Status.’

- Enter your PAN number and Aadhaar number.

- Click the ‘View Link Aadhaar Status’ button.

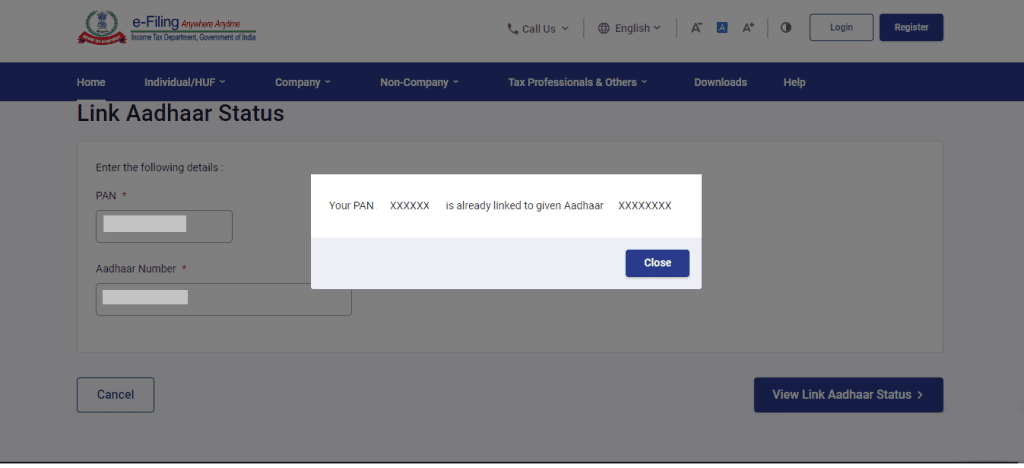

You will receive a message confirming your Aadhaar-PAN link status. If your Aadhaar is linked to your PAN card, the message will state, “Your PAN is already linked to the given Aadhaar.” If the linking process is in progress, the message will inform you that the request has been sent to UIDAI for validation. If your Aadhaar is not linked, the message will prompt you to link your Aadhaar with PAN.

Method 2: Checking by Logging into the Income Tax Portal

- Login to the Income Tax e-filing portal.

- Go to the ‘Dashboard’ or ‘My Profile’ section.

- Click on the ‘Link Aadhaar Status’ option.

If your Aadhaar is linked with your PAN card, your Aadhaar number will be displayed. If it is not linked, the ‘Link Aadhaar Status’ will be shown.

Direct Link to Check Aadhaar Card PAN Card Link Status

To directly check the Aadhaar-PAN card link status, you can visit the following link: [https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status]. Enter your PAN and Aadhaar numbers, then click on ‘View Link Aadhaar Status’ to view the PAN-Aadhaar linking status.

How To Check Aadhaar Card PAN Card Link Status via SMS?

You can also check the link status by sending an SMS. Follow these steps:

- Compose an SMS with the following format: UIDPAN <12-digit Aadhaar number> <10-digit PAN number>.

- Send the SMS to either ‘567678’ or ‘56161.’

- Wait for a response from the government service.

If your Aadhaar is linked with PAN, the response will confirm the association. If they are not linked, the message will indicate that the Aadhaar is not associated with the PAN.

How to Link Aadhaar with PAN Card Online

If your Aadhaar is not linked with your PAN card, follow these steps to link them online:

- Go to the Income Tax e-filing portal.

- Under the ‘Quick Links’ heading, click on ‘Link Aadhaar.’

- Enter your PAN number and Aadhaar number.

- Click the ‘Validate’ button.

- Proceed to pay the late penalty of Rs.1,000 by clicking on the ‘Continue to Pay Through e-Pay Tax’ button.

- Enter your PAN, mobile number, and click ‘Continue.’

- Under the ‘Income Tax’ tab, click ‘Proceed.’

- Pay the challan amount and click ‘Continue.’

- Go back to the ‘Quick Links’ section and click ‘Link Aadhaar.’

- Enter your PAN and Aadhaar, then click the ‘Validate’ button.

- Enter your Aadhaar number, mobile number, OTP, and click ‘Validate.’

Your request for Aadhaar-PAN linking will be sent to UIDAI for validation.

Alternative Method: Visit a PAN Card Centre

You can also visit a PAN card centre and submit the Aadhaar-PAN card linking request form in order to link your Aadhaar card with your PAN card.

Fees for Aadhaar PAN Card Linking

Initially, the PAN-Aadhaar linking process was free until 31st March 2022. From 1st April 2022 to 30th June 2022, a penalty of Rs.500 was imposed for late linking. However, after 30th June 2022, a penalty of Rs.1,000 is now imposed. Therefore, it is important to pay the penalty before 30th June 2023 to link your Aadhaar with your PAN. Failure to do so will result in your PAN card becoming inoperative from 1st July 2023.

Who Should Link Aadhaar with a PAN Card?

According to Section 139AA of the Income Tax Act, all taxpayers with a PAN card must link it to their Aadhaar cards. However, certain categories are exempt from this requirement. Non-Resident Indians (NRIs), individuals aged above 80 years, and residents of Assam, Meghalaya, and Jammu and Kashmir do not need to link their Aadhaar with PAN. It is essential to check the Aadhaar-PAN link status and ensure the linkage before 30th June 2023 to avoid rendering your PAN card inoperative.

Frequently Asked Questions

What is the amount of fees payable for Aadhaar-PAN linking?

The fee to pay Aadhaar-PAN linking is Rs.1,000, which should be paid in a single challan.

Should I pay the penalty before applying for Aadhaar-PAN card linking?

Yes. You can apply for PAN-Aadhaar linking only afer paying the penalty of Rs.1,000.

Is Aadhaar-PAN linking compulsory for all?

All taxpayers must link their Aadhaar-PAN before 30 June 2023, else their PAN will be inoperative. However, the following persons are not required to link their Aadhaar with PAN:

- Persons residing in the States of Jammu and Kashmir, Assam and Meghalaya

- A non-resident person as per the Income-tax Act, 1961

- Persons who are not citizens of India

- Persons of eighty years or more at any time during the previous year

Which payments are considered valid for Aadhaar-PAN linking?

The payments done through e-Pay Tax functionality on the Income Tax Filing Portal for an amount of Rs.1,000 from 1st July 2022 in a single challan are considered as valid for Aadhaar-PAN linking.

Can I make multiple payments under minor code 500 to pay the penalty?

No, there should not be an aggregation of challans with ‘Minor head 500’ to pay the amount of Rs.1,000.