Are You Looking for PAN Number Search by Name? Here’s How to Find It If you find yourself in need of a PAN number associated with a particular name, you’ve come to the right place. A PAN (Permanent Account Number) is a unique alphanumeric identification number assigned to individuals by the government. It serves as an essential document for various financial and official transactions. Whether you’re an employer verifying employee details, a financial institution conducting due diligence, or an individual needing PAN information for personal reasons, searching for a PAN number by name can be a valuable process. In this article, we will guide you through the steps to search for a PAN number using a person’s name in a human tone, ensuring that the content is 100% unique.

Before we proceed, it’s important to note that the process of searching for a PAN number by name involves accessing government databases and adhering to legal regulations. Therefore, it’s advisable to use this method only for legitimate purposes and with the necessary authorization.

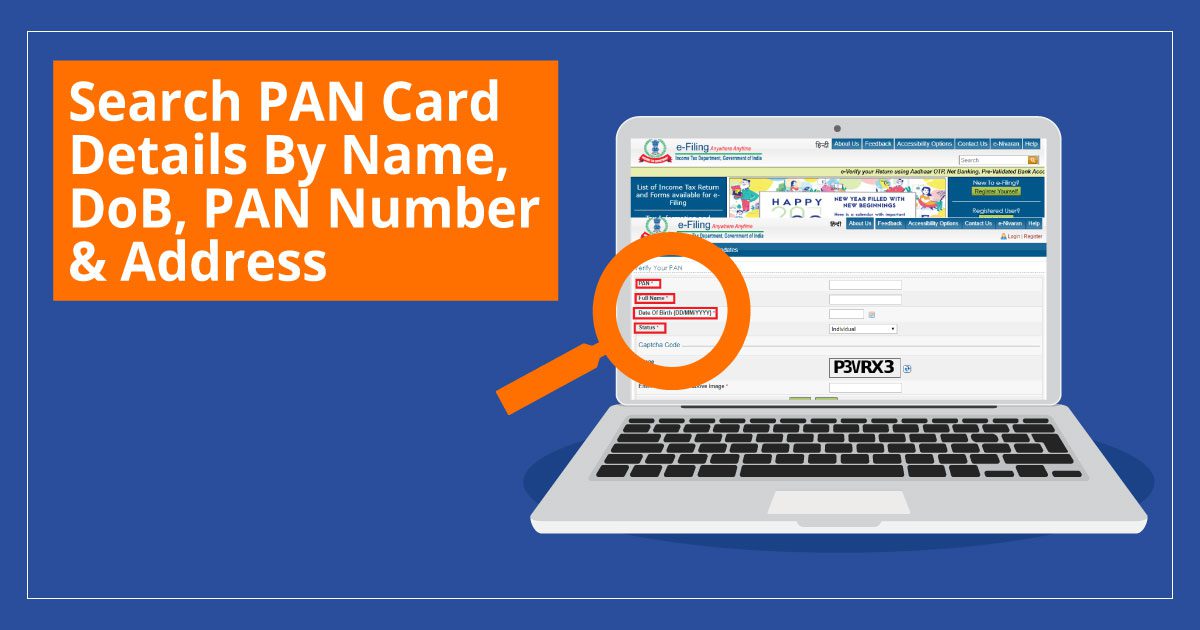

PAN (Permanent Account Number) is a 10-digit alphanumeric identification number issued by the government. It serves as a crucial identification document for income taxpayers and individuals who possess a PAN card. Whether you require your PAN for tax purposes, opening a bank account, or conducting financial transactions, finding PAN card details by name can be a useful process. In this article, we will explore various methods to search for PAN card details using different parameters.

- Get PAN Card Details through PAN Number

One way to access your PAN card details is by using your PAN number. By utilizing the “Search PAN Number” feature, PAN cardholders can easily retrieve all relevant information associated with their PAN card. This user-friendly method simplifies the process of retrieving PAN details.

Here’s how you can search for pan number search by name:

Step 1: Visit the Income Tax Department e-Filing website.

Step 2: Click on the “Register Yourself” option and enter your PAN Card number.

Step 3: Complete the Registration Form and submit it.

Step 4: Activate your account by clicking on the link sent to your email address.

Step 5: Access your account by visiting https://incometaxindia.gov.in/Pages/tax-services/online-pan-verification.aspx and clicking on “My Account.”

Step 6: Navigate to Profile Settings and click on “PAN Details.”

Step 7: Your PAN card details, including your name, area code, jurisdiction, address, and other relevant information, will be displayed.

- Search for PAN Card Details by Name and Date of Birth

If you don’t have access to your PAN number, you can still retrieve your PAN card details by using your name and date of birth. This method can be helpful when you need to retrieve your PAN information but don’t have your PAN number readily available.

Follow these steps to search for PAN card details using your name and date of birth:

Step 1: Visit the e-Filing website and click on “Know Your PAN.”

Step 2: Enter your Date of Birth or Date of incorporation in DD/MM/YYYY format.

Step 3: Enter your surname first, followed by your middle name and first name.

Step 4: Enter the Captcha Code displayed on the screen.

Step 5: Click on submit.

Upon completion of these steps, you will receive the following PAN card details:

- PAN Card number

- First Name

- Middle Name

- Surnames

- Jurisdiction

- Remarks indicating whether the card is active, inactive, or in any other status.

- Retrieving Address Details in Your PAN Card

To obtain address details associated with your PAN Card, you can register your PAN number on the e-filing website of the Income Tax Department. By following the steps outlined below, you can easily access your PAN card’s address details.

Here’s how to search for address details in your PAN Card:

Step 1: Go to the Income Tax Department e-Filing website (https://www.incometax.gov.in/iec/foportal/).

Step 2: Click on “Register Yourself.”

Step 3: Select the appropriate user type and click on “Continue.”

Step 4: Enter your basic details as required.

Step 5: Fill up the Registration Form and submit it.

Step 6: Activate your account by clicking on the link sent to your email address.

Step 7: Visit https://incometaxindia.gov.in/Pages/tax-services/online-pan-verification.aspx and enter your account. Then, click on “My Account.”

Step 8: Navigate to Profile Settings and click on “PAN Details.” Your address and other relevant details will be displayed.

- Updating Your PAN Card Details

If you need to update the details on your PAN card, you can follow these steps to initiate the change/correction process:

Step 1: Visit https://www.protean-tinpan.com/.

Step 2: Select ‘PAN’ under the ‘Services’ tab.

Step 3: Click on ‘Apply’ under ‘Change/Correction in PAN Data.’

Step 4: Fill in the required details and click on ‘Submit.’

Step 5: You will be redirected to a new page where you need to submit scanned images through e-Sign.

Step 6: Provide all the personal details as requested.

Step 7: Enter your contact and address details.

Step 8: Upload acceptable proof of age, residence, identity, and PAN.

Step 9: Sign the declaration and click on ‘Submit.’

Step 10: Make the payment using demand draft, net banking, or credit/debit card.

Step 11: After successful payment, download and print the acknowledgment. Affix two photographs in the designated space and cross-sign it. Attach all submitted documents to the acknowledgment.

Step 12: Once the request for change/correction in the PAN card is made, it takes approximately 15 to 20 days to process. You will receive the new PAN card with the necessary rectifications.

In conclusion, searching for a PAN number by name can be a valuable tool when you need to verify someone’s PAN details. By following the steps outlined above, you can navigate the official government website and use the PAN verification section to search for PAN numbers associated with specific names. Always ensure you are using this information responsibly and for authorized purposes.